Brand: Abu Dhabi Int. Commercial Bank

INDUSTRY: Finance

COUNTRY: EGYPT

Top UAE Bank ADCB Empowers Brand Growth in Egypt Through Its Website

A seamless integration of modern web design and banking services tailored to ADCB Egypt’s growing customer base

Client Overview

Abu Dhabi Commercial Bank is a major financial institution from the United Arab Emirates. It serves retail and corporate customers with numerous offers of traditional and digital solutions for their financial needs. In 2020, the bank expanded into the Egyptian market. Its expansion strategy called for an excellent website to represent its services in the country, so the bank needed a renowned web development company to build a website meeting its high standards.

Services Utilized

Tech Stack

Products Offered

Business Functions Served

The Challenge

As the Abu Dhabi Commercial bank offers many different services while maintaining a high standard of customer service and satisfaction, it needed the same experience for its Egyptian customers. The website had to meet all quality expectations, comply with banking regulations, and ensure the user experience outclasses all competitors.

Objects development agency is ADCB’s website development partner.

There were unique operational trials for Objects in completing the work for a financial industry client.

Working within these constraints helped Objects attain valuable planning and execution insights for future clients in the financial industry.

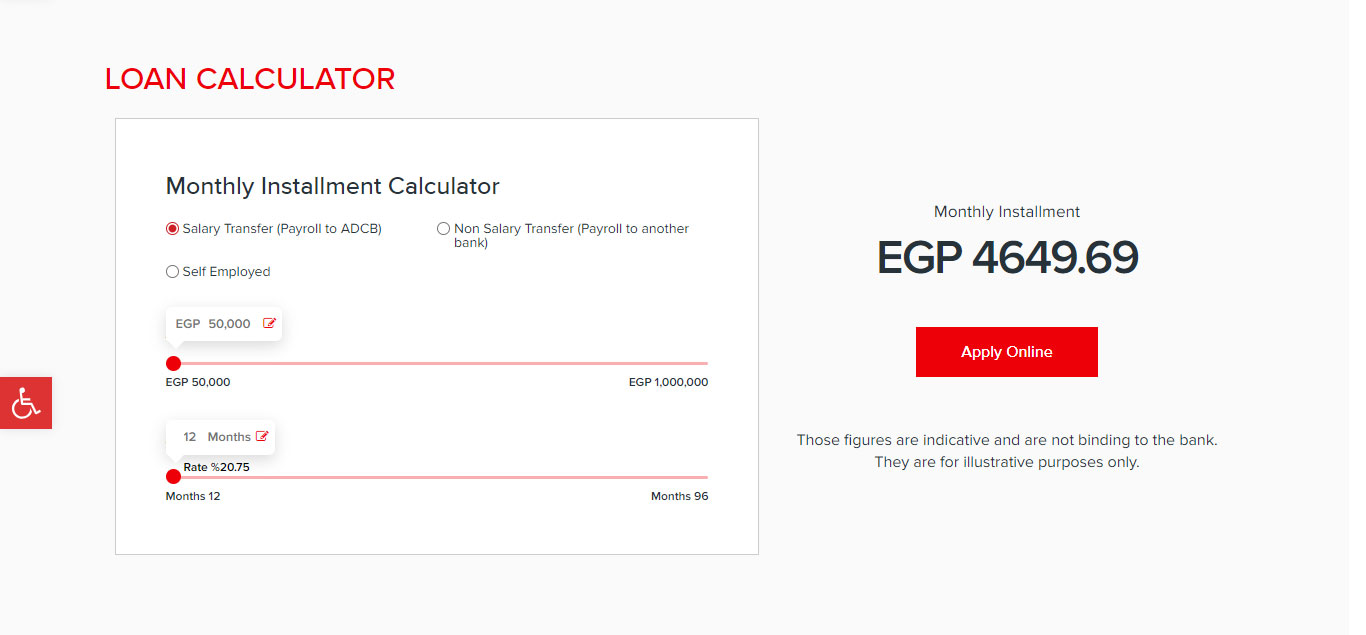

Among the most common banking products utilized by customers are personal loans. These can be in demand due a variety of needs in a person’s life. Many people who are skeptical or on-the-fence about taking loans.

However, if a consumer gets a bank quote of a particular monthly installment amount, they might seek more information and ultimately become loan customers. Abu Dhabi Commercial Bank needed to convey loan information in the best way to website visitors.

The Abu Dhabi Commercial Bank cares about customer experience. The bank wanted users to be able to not just get information about, but also apply for any type of personal or business account via its website.

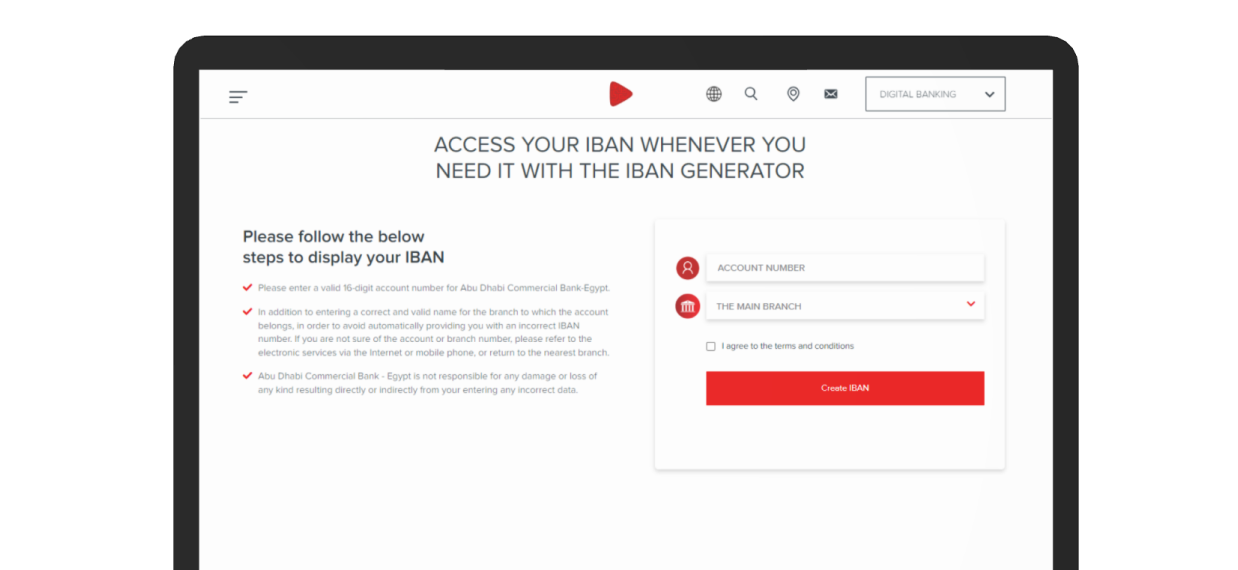

Touchpoint integration was necessary to make this possible. A method of ingesting applicant details through forms or other methods was imperative. After the account creation, the bank wanted its customers to be able to look up their account ID information with ease.

For many Abu Dhabi Commercial Bank customers, international travel, transactions, and business dealings are the norm. They are highly interested in obtaining up to date information on currency exchange rates. The Bank needed a reliable method of displaying such fast-changing information on its website.

The Abu Dhabi Commercial Bank segments its customers into three major categories, and offers several products and services. Each needed its own web pages, landing pages, resources, and layouts. This required a complex structure of the website, which needed to be presented through user-friendly navigational paths. Also, due to the variation in content of each category, different templates and post types were necessary for each.

The financial industry is understandably highly regulated. The Abu Dhabi Commercial Bank has to comply with many types of regulations not just in branch operations, but also on its website. This entails professional presentation of information, disclaimers, disclosures, obtaining KYC from applicants, and more.

Our Solution: Effective Loan Calculator

Objects developers implemented an interactive loan calculator on the ADCB website. This loan calculator works by taking input of loan principal amount and loan tenor through sliders, and outputting an estimated but rather accurate monthly installment amount in EGP.

Building the loan calculator involved:

Our Solution: Realtime Data

The Abu Dhabi Commercial Bank wanted to control the currency exchange rates displayed on its website in a completely dynamic way.

Objects recommended using an API that changes the currency rate as per the instantaneous rate, but ADCB wanted to control it manually, which we implemented. Objects developers enabled ADCB to upload a file containing currency rates from the database.

To ensure that the feature is provided smoothly to the front end, we created a special table to display the exchange rate change and the buying and selling prices of each currency.

Our Solution: Technical Compliance

To meet the banking sector’s various data security compliances, Objects crafted creative technical solutions during the development process. Objects developers requested temporary bank server access from the bank until we finished some crucial procedures. Objects’ development team’s IP addresses were whitelisted on the ADCB’s server machine.

Technical personnel in the financial industry will know that this is a bureaucratic procedure which requires patience for software developers, who are used to following Agile methodologies.

As Objects kept extensive open communication with ADCB’s team, they expressed the desire to develop the website further on their own in the future. They conveyed a vision for the types of posts, content and features the wanted to deploy. Objects created the foundation of independent development by Abu Dhabi International Commercial Bank by building and handing over templates that would endure for many years to come.

After launch, Abu Dhabi International Commercial Bank’s website is:

Feature-rich with all relevant tools and information presented in modern design

Complies with all banking sector regulations

Facilitates customers through account creation, digital banking, financial information

Related Case Studies

Fueling Growth Through Web & Mobile: NAFT’s Story

eCommerce

Gas station brand NAFT provides motorists and businesses next-gen petroleum solutions and services through an eCommerce website & mobile app

LandFleet’s Route to Growth:

Great Web & App Experiences

Logistics

LandFleet, as the name implies, is a fleet management company handling both heavy and light transportation needs for businesses. The company employs high-tech solutions to keep…

Concrete’s eCommerce

Transformation: Enhancing User…

Finance

For over 35 years, Concrete has been synonymous with men’s fashion. Initially focused on denim and cotton, the brand transitioned to more premium apparel products for men and kids.

What We Do for your Success

Need Specific Help?

Still don’t know what to do?

Reach out to our expert team.

"*" indicates required fields