- Home

- About us

- Flexible pricing

- No Communication barrier

- Quality focused

- Customer Centric

- Agile approach

Years of Experience0 +Objects started with 4 resources in 2011, and today we are a leading service provider in the Custom Website & Software development domain.Projects Completed0 +With over 5,000+ successfully completed projects, we have experience working in various industries, providing unmatched quality.Team Members0 +With over 180 team members, we have on boarded expertise in the most common and widely used technology stacks and Content Management Systems. - Why us

- Portfolio

- ServicesServicesDon’t see the service you need? or not sure what services are required for your project?Odoo & ERP Solutions

Objects is an official partner with Odoo and has vast experience in Odoo development services.

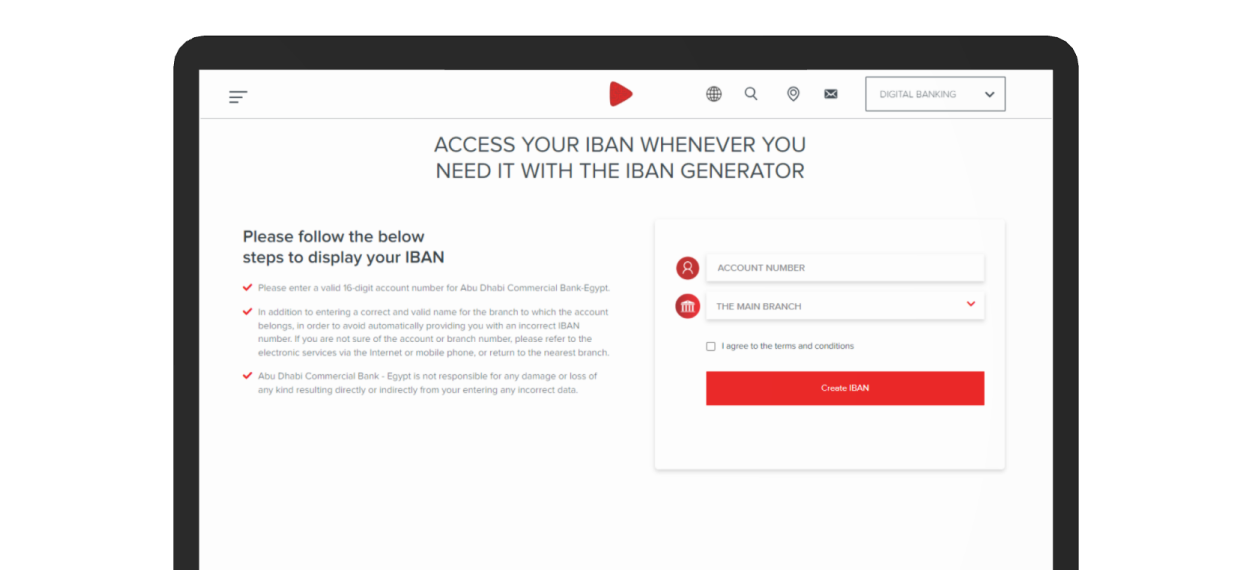

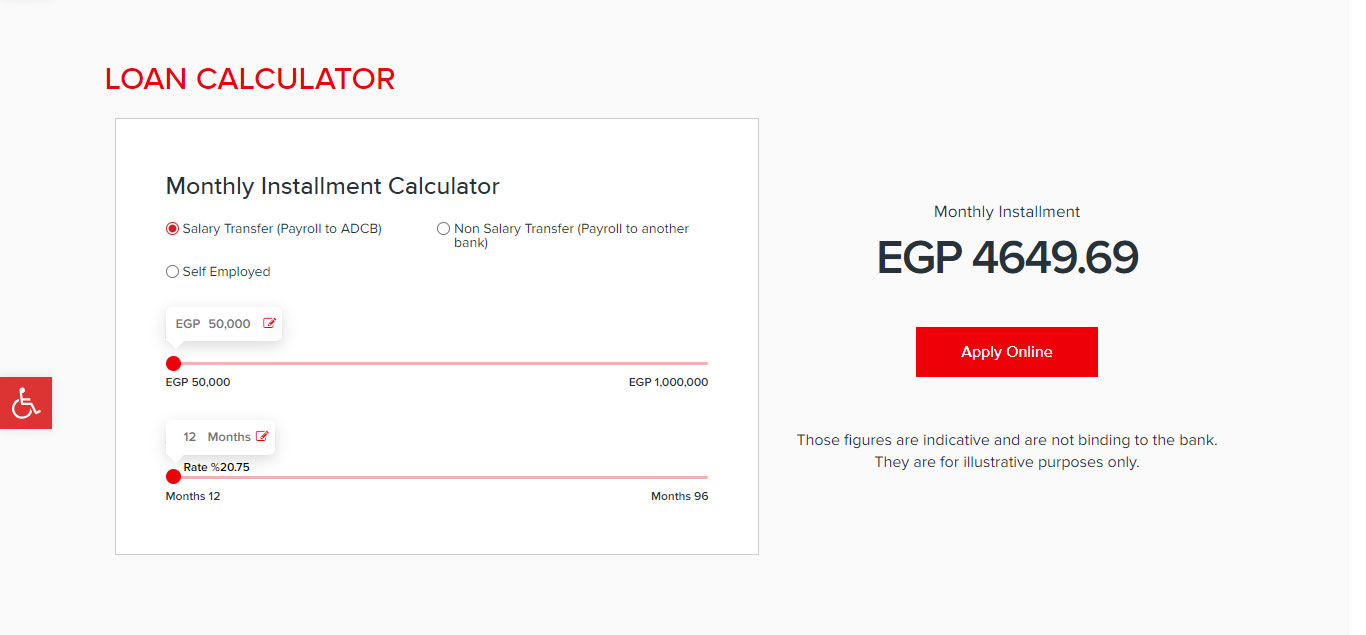

Website & Web AppA website is virtual identity, we offer results driven digital transformation, website and web app development services

Product DevelopmentObjects offers the ability for visionaries to build and manage software as a service products through a collaborative approach.

API & Integration ServiesObjects offers bespoke API and Integration services, enabling your business to take advantage with value adding tools.

Mobile App DevelopmentWe offer a wide range of native, hybrid, cross platform and PWA Mobile app development services

B2B & B2C EcommerceWe offer custom |B2B and B2C Ecommerce development and implementation services

- Blog

- Careers

- Home

- About us

- Flexible pricing

- No Communication barrier

- Quality focused

- Customer Centric

- Agile approach

Years of Experience0 +Objects started with 4 resources in 2011, and today we are a leading service provider in the Custom Website & Software development domain.Projects Completed0 +With over 5,000+ successfully completed projects, we have experience working in various industries, providing unmatched quality.Team Members0 +With over 180 team members, we have on boarded expertise in the most common and widely used technology stacks and Content Management Systems. - Why us

- Portfolio

- ServicesServicesDon’t see the service you need? or not sure what services are required for your project?Odoo & ERP Solutions

Objects is an official partner with Odoo and has vast experience in Odoo development services.

Website & Web AppA website is virtual identity, we offer results driven digital transformation, website and web app development services

Product DevelopmentObjects offers the ability for visionaries to build and manage software as a service products through a collaborative approach.

API & Integration ServiesObjects offers bespoke API and Integration services, enabling your business to take advantage with value adding tools.

Mobile App DevelopmentWe offer a wide range of native, hybrid, cross platform and PWA Mobile app development services

B2B & B2C EcommerceWe offer custom |B2B and B2C Ecommerce development and implementation services

- Blog

- Careers